Table Of Contents

What is the Risk-Free Rate Formula?

A risk-free rate of return formula calculates the interest rate that investors expect to earn on an investment that carries zero risks, especially default risk and reinvestment risk, over some time. It is usually closer to the base rate of a Central Bank and may differ for the different investors. It is the rate of interest offered on sovereign or government bonds or the bank rate set by the country's Central Bank. These rates are the function of many factors like – Rate of Inflation formula, GDP Growth rate, foreign exchange rate, economy, etc.

Image Source: Financial Modeling and Valuation

The risk-free rate of return is a key input in arriving at the cost of capital and hence is used in the capital asset pricing model. This model estimates the required rate of return on investment and how risky the investment is compared to the total risk-free asset. It is used to calculate the cost of equity, which influences the company’s WACC.

Below is the formula to derive the Cost of Equity using the risk-free rate of return using the model :

CAPM Model

Re = Rf+Beta (Rm-Rf)

where,

- Re: Cost of Equity

- Rf: Risk-free rate

- Rm: Market Risk Premium

- Rm-Rf: Expected Return

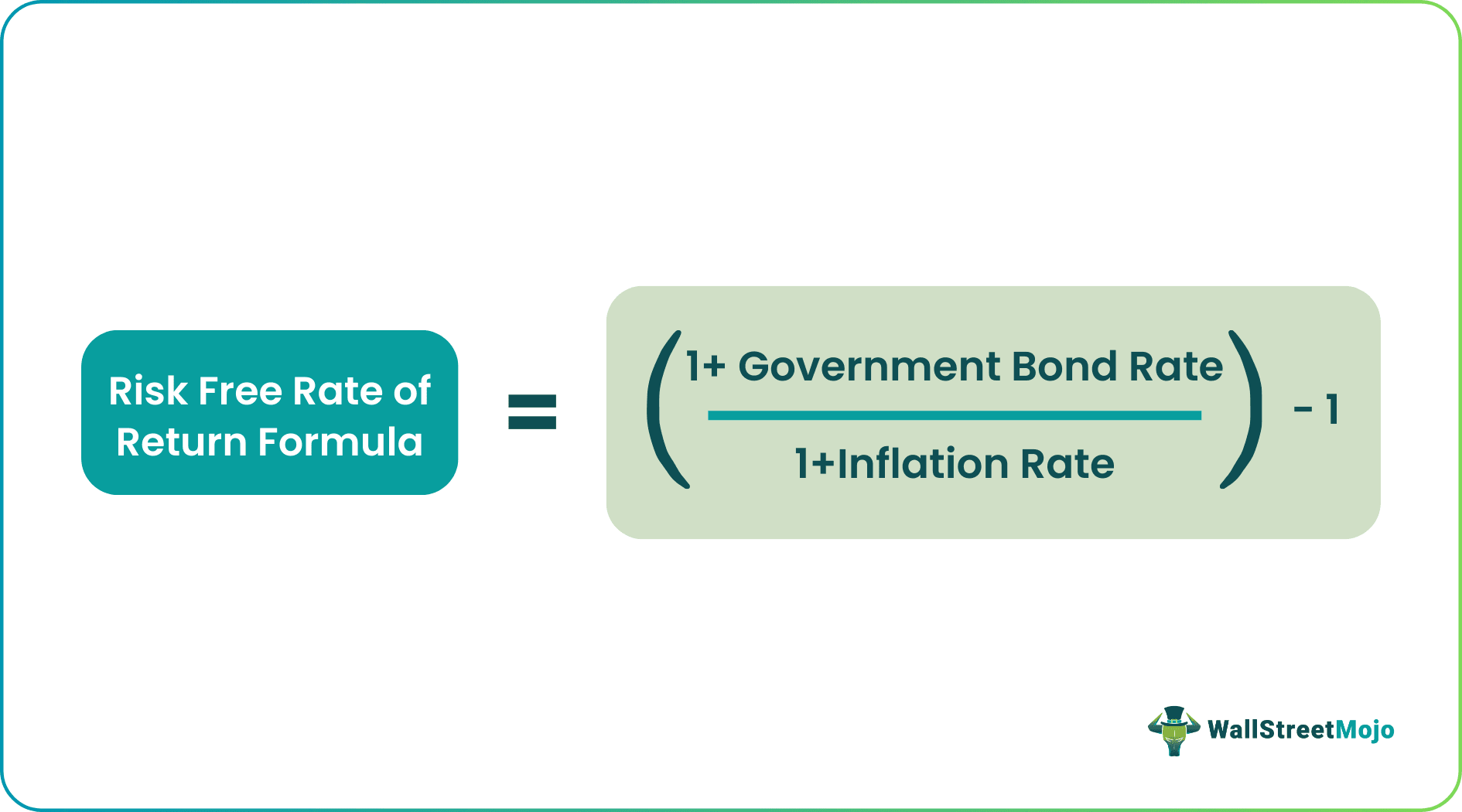

However, It is usually the rate at which the government bonds and securities are available and inflation-adjusted. The following formula shows how to arrive at the risk-free rate of return:

Risk Free Rate of Return Formula = (1+ Government Bond Rate)/ (1+Inflation Rate)-1

This risk-free rate should be inflation-adjusted.

Key Takeaways

- Risk-free rate of return formula calculates investors' expected interest rate on zero-risk investments, typically closer to a Central Bank's base rate. It depends on factors like inflation, GDP growth, foreign exchange rate, and economy.

- The risk-free rate of return is crucial for estimating capital cost, influencing asset price models, and calculating the cost of equity, impacting a company's WACC.

- Investors gain from an increased risk-free rate of return since it shows that the government is stable and confident. Companies may face pressure to boost stock prices to meet investors' expectations for increased profits.

Explanation of the Formula

The various applications of the risk-free rate use the cash flows in real terms. Hence, the risk-free rate must also be brought to the same real terms, which is inflation-adjusted for the economy. Since the rate is mostly the long-term government bonds – they are adjusted to the rate of inflation factor and provided for further use.

Image Source: Finacial Modeling and Valuation Course

The calculation depends upon the period in evaluation.

- If the period is up to 1 year, one should use the most comparable government security, which is the Treasury Bills, or simply the T-Bills

- If the period is between 1 year to 10 years, one should use a Treasure Note.

- If the period is more than ten years, one can consider selecting Treasure Bond.

Examples of instruments with Risk-Free Rates

The government of any country is assumed to have zero default risk as they can print money to pay back their debt obligation as required. Therefore, the interest rate on zero-coupon government securities like Treasury Bonds, Bills, and Notes, are generally treated as proxies for the risk-free rate of return.

Examples of Risk-Free Rate of Return Formula (with Excel Template)

Let’s see some simple to advanced examples to understand it better.

Example #1

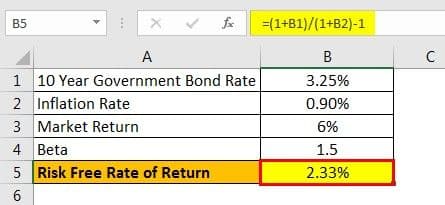

Use the following data for the calculation of the risk-free rate of return.

- 10 Year Government Bond Rate: 3.25%

- Inflation Rate: 0.90%

- Market Return: 6%

- Beta: 1.5

The risk-free rate of return can be calculated using the above formula,

=(1+3.25%)/(1+0.90%)-1

The answer will be –

Risk-free Rate of Return = 2.33%

The cost of equity can be calculated using the above formula,

=2.33%+1.5*(6%-2.33%)

Cost of Equity will be –

Cost of Equity = 7.84%

Example #2

Below is the information for India for the year 2018

- Rate of Inflation: 4.74%

- 10 Year Government Bond: 7.61%

The risk-free rate of return can be calculated using the above formula,

=(1+7.61%)/(1+4.74%)-1

The answer will be –

Risk-free Rate of Return = 2.74%

Applications

The rate of return in India for the government securities is much higher than the U.S. rates for the U.S. Treasury. It is factored by the growth rate of each economy and the stage of development at which each stands. Therefore, the investors are shifting and considering investing in Indian government securities and bonds. The availability of such securities is easily accessible as well.

The largely used models involving the risk-free rate are:

- Modern Portfolio Theory - Capital Asset Pricing Model

- Black Scholes Theory - Used for Stock Options and Sharpe Ratio – is a model used for the financial market dynamics containing derivative investment instruments.

The relevance of the Risk-Free Rate of Return Formula

It can be seen from the two perspectives: the business and the investors' perspective. From an investor's point of view, a rising risk-free rate of return signifies a stable government, a confident treasury, and, ultimately, the ability to expect high returns on one's investment. On the other hand, a rising risk-free rate scenario can be problematic for businesses.

Image Source: Finacial Modeling and Valuation Course

The companies would have to now meet the investors' expectations of higher returns by improving stock prices. It might turn stressful as the business would now have to show good projections and have to thrive on meeting these profitability projections.